Tips for Filing a Renters Insurance Claim After a Fire

6/13/2022 (Permalink)

If you rent your home in Tuckahoe, NY, you need renters insurance to cover expenses in case of a fire or another covered peril.

If you rent your home in Tuckahoe, NY, you need renters insurance to cover expenses in case of a fire or another covered peril.

After a Fire, Here Are Some Tips for Filing a Renters Insurance Claim

If you rent your home in Tuckahoe, NY, you need renters insurance to cover expenses in case of a fire or another covered peril. Most tenants don't know how far those benefits reach, though. When filing your claim after a fire, be sure to include the following costs, if applicable to your circumstances.

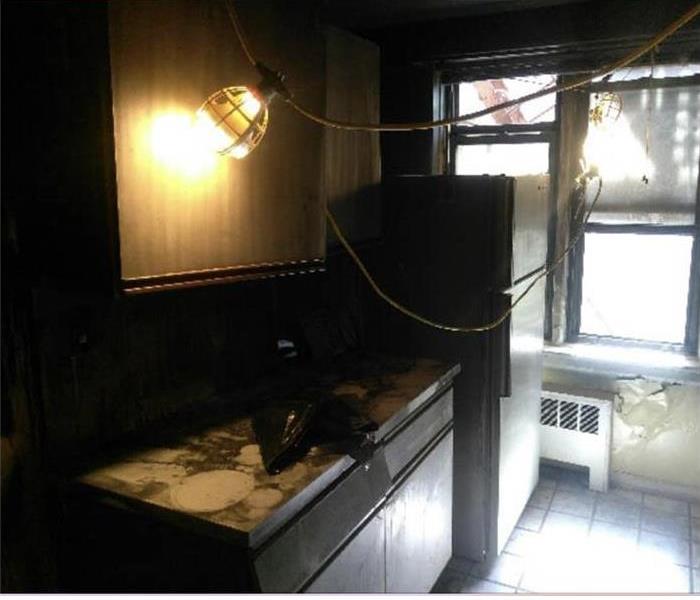

Fire Damage to Belongings

One document you should prepare before you file your claim is an itemized list of belongings damaged by the fire and how much it costs to replace them. Your policy should cover all your personal property:

- Furniture

- Electronics

- Clothing

- Food

- Valuables

You may be surprised how many items fire restoration experts can repair. If they cannot be fixed, however, your provider should recoup the replacement cost rather than the depreciated value of the items.

Limited Liability

A fire can break out in your apartment due to your negligence. If this happens, the liability clause in your renters' insurance policy is likely to come into play. This protects you in the event that a third party has damages due to anything you did that led to the fire.

Medical Expenses

Even if you do everything right, it is still possible that someone can get injured when fleeing the burning building. Most policies for renters can cover medical expenses to a certain extent. Check with your agent to see how much coverage an injured party can get.

Temporary Relocation

If there is a lot of damage to the structure of the rental property, it may take some time to repair. You will probably have to live somewhere else while it is mitigated. Your policy should cover the cost of the hotel room or other temporary accommodations.

You may not know a lot about your renters' insurance policy until you need to file a claim. Chances are good that it covers more than you expect.

24/7 Emergency Service

24/7 Emergency Service